Zevia: Healthy Beverage Producer With 25-30% Revenue Growth (NYSE:ZVIA)

helivideo/iStock through Getty Pictures

Introduction

Zevia PBC (NYSE:ZVIA) is one of the more recent ‘healthy drinks’ businesses out there, and I assume the firm has done a excellent occupation in developing brand name awareness. I have experimented with numerous of their items and though some of their carbonated waters or lemonades are tastier than some others, I realize the firm’s push to decrease the sugar use amounts of its individuals. That’s also why the organization is a PBC, a Public Advantage Corporation which implies that Zevia is not solely interested in revenue maximalization but balancing earnings and goal (advertising a more healthy daily life type). Zevia PBC is the holding company of Zevia LLC which is running as a partnership.

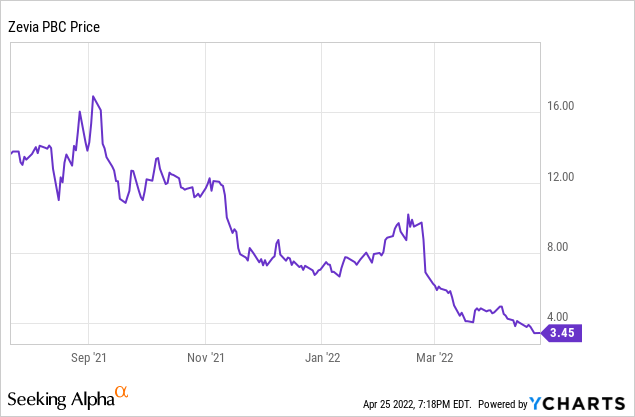

The share price tag is at this time trading at just above $3.5/share, which is 75% lower than the $14 IPO price. The A shares are listed on the trade while the B-shares symbolizing a 47% stake in the underlying running entity, Zevia LLC, are not shown and accounted for as ‘non-controlling interests’.

Zevia: A great ‘healthy beverage’ organization

Zevia has various diverse item offerings, ranging from sodas to electricity drinks though it also has a merchandise providing concentrating on little ones and a mixer solution. Soda is by considerably the most important merchandise as it accounted for 87% of the company’s income in 2021. The other items have been all introduced in the previous five decades and are still positioning on their own on the respective markets they are concentrating on.

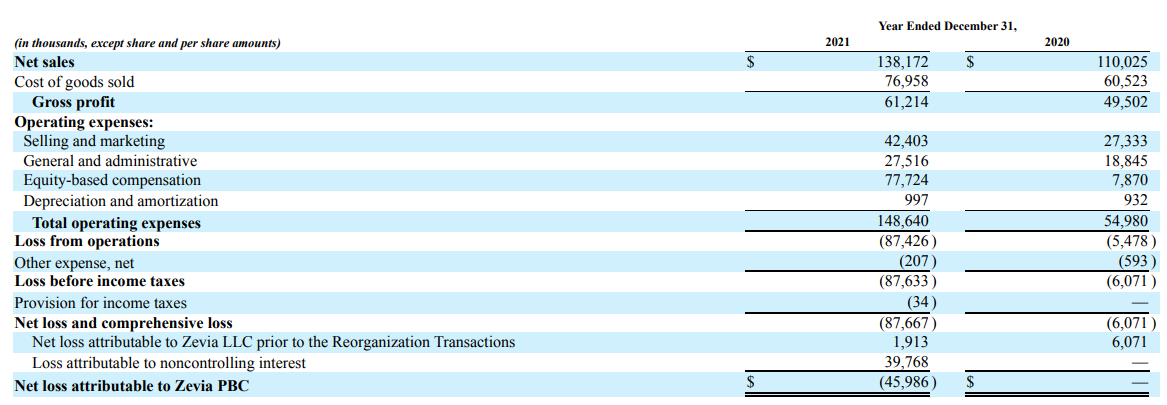

Zevia Investor Relations

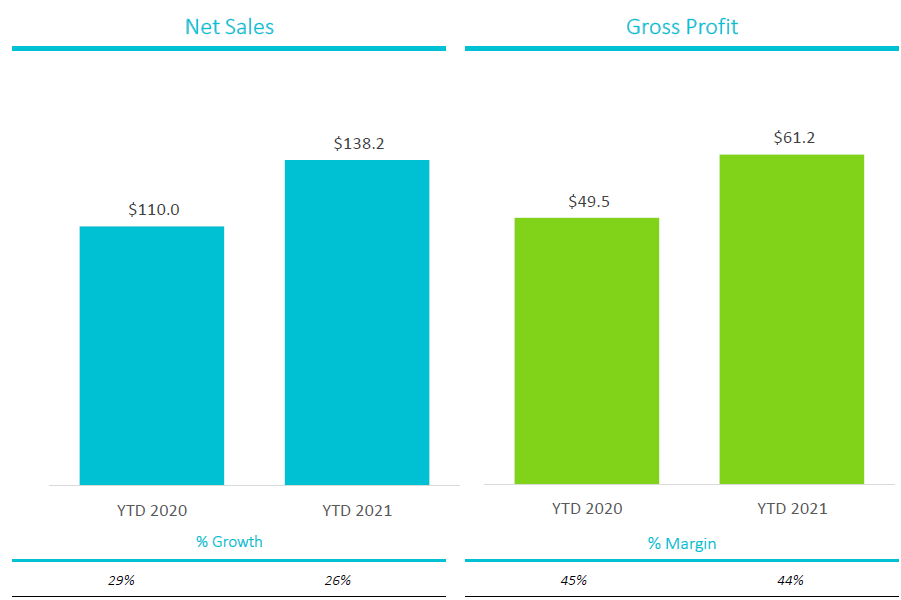

The company noticed its earnings enhance by just in excess of 25% in 2021, resulting in a whole earnings of just over $138M. The COGS amplified by a identical share (as Zevia outsources the production as aspect of its asset-mild company product) resulting in a 25% raise of the gross financial gain to $61.2M.

Zevia Investor Relations

This failed to suggest the organization was profitable. The overall amount of money of functioning costs came in at practically $149M and the bulk of these bills were being related to the equity-centered payment deal. The web reduction was just less than $88M of which about $40M was attributable to the non-managing pursuits (represented by the B-shares). The A-shares, which are the typical shares shown on the trade, described an EPS of a damaging $1.33/share. Excluding the share-dependent compensation, Zevia’s base line would continue to have been unfavorable, but the business is pretty close to a crack-even predicament.

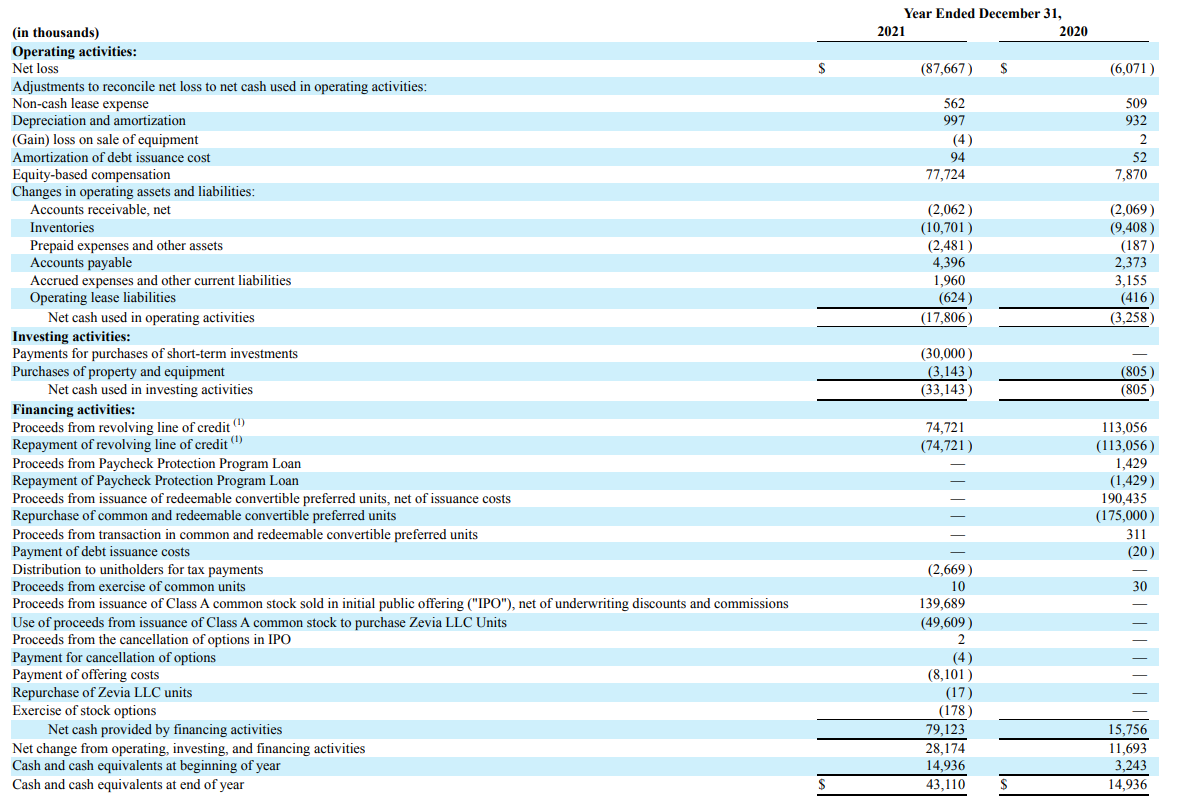

As share-based compensation is just not a income product, the company’s funds circulation assertion appears to be like significantly far better than the reported internet revenue. Whilst the working funds circulation was a negative $17.8M, this was largely brought about by modifications in the performing capital placement (with a $10.7M buildup of inventory levels). Modified for these operating capital modifications, the running cash move was a destructive $8.3M.

Zevia Investor Relations

The total capex was just $3.1M, ensuing in a unfavorable free hard cash stream of $11.4M. Be aware, this is on the Zevia LLC degree. So about 47% of this detrimental free money movement was attributable to the non-managing pursuits.

The firm invests closely in model consciousness, profitability will appear afterwards

Zevia is acquiring shut to its breakeven level, and I imagine it’s now all about economies of scale. The gross financial gain will possible carry on to evolve alongside with the income maximize (as the gross margin continues to be really constant in the mid-40s selection), so it will be essential to see a decrease growth fee of the SG&A bills.

Zevia Investor Relations

For 2022, Zevia is guiding for a 28-32% revenue raise to $177-182M and this could and need to be a big phase forward to attain a crack-even situation. As the brand awareness levels continue to boost, Zevia must be equipped to see a reduction in its advertising expenditure for every can marketed and this need to drive the economical overall performance. The promoting & internet marketing bills improved by far more than 50% in 2021 as opposed to 2020 so there incredibly evidently was a advertising press by Zevia and I hope the corporation will reap the rewards this calendar year.

Investment thesis

I ordinarily only (or at the very least generally) spend in providers with a regarded hard cash movement efficiency as that would make it a lot easier to figure out the honest value of a firm. Even so, the share price of Zevia has now dropped so considerably that the organization has gotten as well inexpensive to overlook. Zevia was worthy of a billion pounds just about a 12 months back and is now trading at a valuation of fewer than $250M which could make the company interesting for a much larger business in the sector on the lookout to develop its products providing.

About 1/3rd of the market place cap is composed of cash and brief-term investments which signifies the organization benefit of Zevia is just about $150M, building it very palatable for about any other player in the beverages sector (that is, of program, assuming the non-managing companions of Zevia LLC would entertain an provide). In addition, the solid equilibrium sheet also implies Zevia has plenty of time to attain its funds flow optimistic stage. And with any luck ,, the new COO and CFO can hit the ground functioning!

I currently never have a placement in Zevia but might initiate a [small] extensive position in the in close proximity to long term.